Our client, a venture capital firm, approached us with a common frustration: they knew AI could improve their workflow, but they needed practical solutions, not technical demonstrations. Years of critical deal information sat scattered across mailboxes and multiple users, making it nearly impossible to find what they needed. Traditional keyword searches were inefficient and incomplete. They had seen impressive AI demos filled with terms like RAG, vector databases, and agents—but as business users, they didn't care about the technology. They needed something that worked seamlessly with their existing processes, required minimal disruption, and delivered immediate value. With our 15 years of building applications that people actually use, we understood what they really needed. We architected and built the Deal Notebook system—a solution that handles the technical complexity behind the scenes while delivering exactly what investment professionals need in their daily workflow.

A leading venture capital firm needed to streamline their deal evaluation process, which involved manually processing numerous investment opportunities daily. Each deal required extensive analysis of pitch decks, financial data, market research, and competitive intelligence. Our AI-powered Deal Notebook system automated this entire workflow, enabling faster, more comprehensive deal analysis while maintaining the highest standards of data security and privacy.

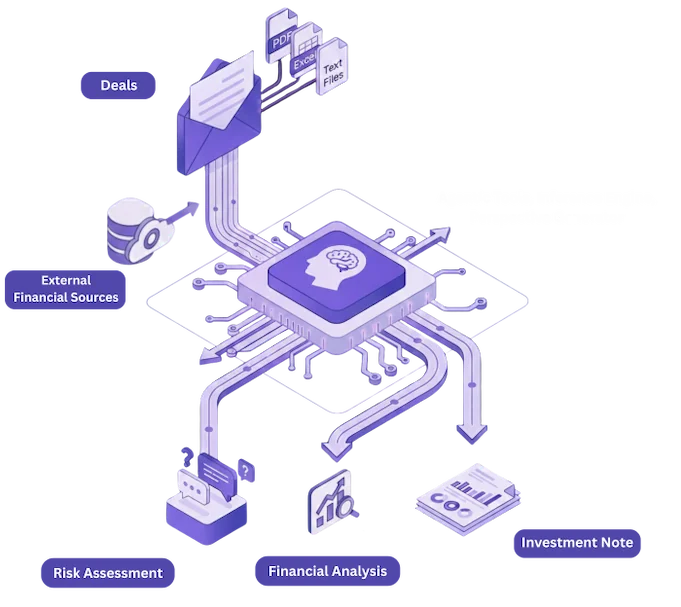

Each slide deck page is converted to high-resolution images and processed through Visual LLMs to extract comprehensive insights and generate structured text summaries.

Agentic collection of competitive landscape data, market intelligence, and financial benchmarks from multiple external sources.

AI synthesizes all data to produce detailed risk assessments, management evaluations, financial analysis, and investment recommendations.

Custom Excel handlers process complex financial models, passing data to LLMs for intelligent analysis and natural language explanations of key metrics.

Vector embeddings enable hybrid search capabilities while knowledge graphs reveal hidden relationships and generate contextual Q&A pairs.

AI automatically processes incoming deal emails, intelligently distinguishing between new opportunities and existing deals, then extracts all relevant content and attachments.

Automated Deal Classification & Notebook Creation

Visual LLM-Powered Document Analysis

Advanced Financial Model Processing

Real-time Competitive Intelligence

AI-Generated Investment Thesis

Hybrid Vector & Graph Search

Interactive Chat Interface

Automated Briefing Note Generation

Deal Status Management

On-Premise LLM Deployment

Faster Deal Analysis

Time Savings on Research

Data Privacy Protection

More Comprehensive Analysis

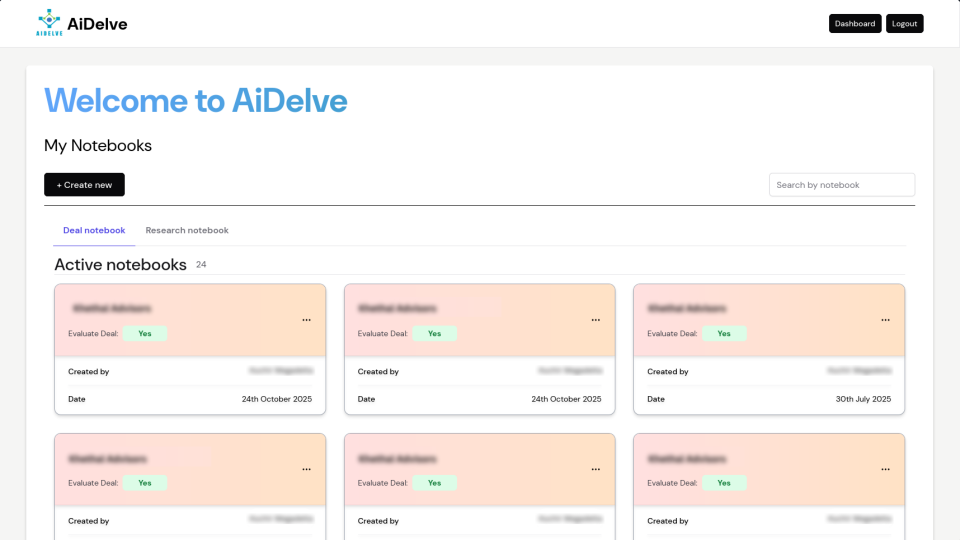

A notebook can be easily created based on the needs of the user. Notebooks are classified with respect to deal notebooks and research notebooks. Deal notebooks are used for deals which are received by external mails. Research notebooks are used for deep research on particular companies or deals. They are also filtered based on status , whether a deal is active or the deal is inactive at that point of time.

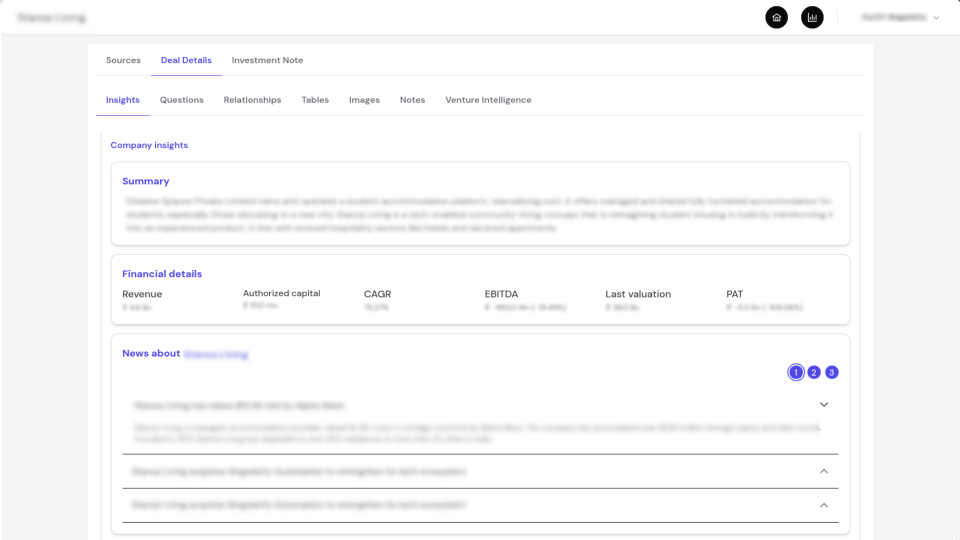

When the deal is uploaded and processed, complete insights of the company, financial details about the company, recent news related to the company are extracted from external sources. The internal data provided are classified and categorized with respect to tables, images and various other fields for easy identification.

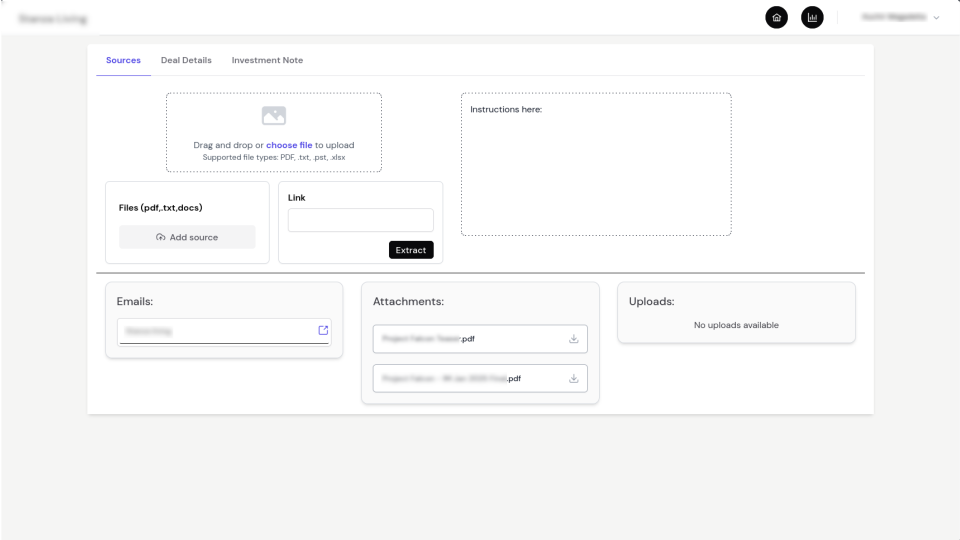

Users have the option to upload text files, PDFs or excel sheets which are processed and are used as internal data for generating an investment note. There is also an option to paste the url and data will get extracted from them.

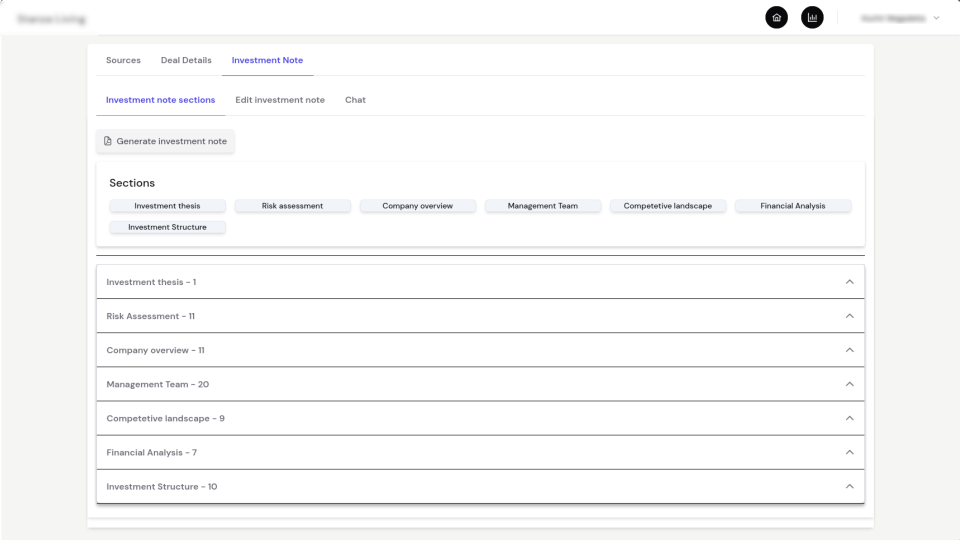

When internal data is combined with uploaded documents, the system identifies and generates relevant categories— such as deal risk assessment, investment structure, management overview, and more. Users can select, add, or refine these categories to ensure completeness and accuracy. Once finalized, the selected categories are synthesized to produce a comprehensive perspective note which are used by the analysts.